Credits: BIGMINT

- Strong crude steel production growth supports imports

- Softer prices in South Asia create buying opportunities

- Japan’s scrap exports to India surge; US remains top exporter

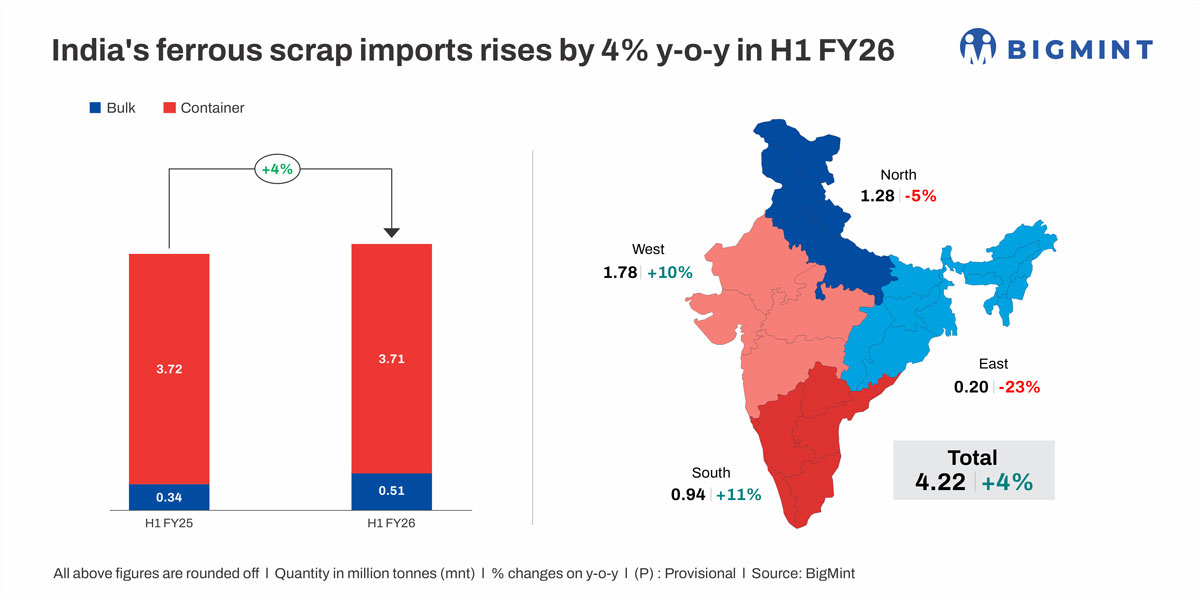

Morning Brief: India’s ferrous scrap imports rose slightly by 4% to 4.22 million tonnes (mnt) in H1FY’26 from 4.06 mnt in H1FY’25, as per data maintained with BigMint.

Imports peaked in April at 0.81 mnt before easing to 0.6 mnt in August and September, following adequate domestic scrap supply, a monsoon-driven construction slowdown, and ample availability of alternative metallics.

Crude steel production rises 12% y-o-y in H1FY’26

The rise in ferrous scrap imports was supported by growing crude steel production, with strong demand from electric arc furnace (EAF) and induction furnace (IF) units. Mills relied on imported scrap to meet premium-grade needs and optimise yields and costs.

Crude steel production increased by 12% y-o-y to 81.86 mnt, while hot metal output was up 8% to 47.35 mnt. Among alternative metallics, both sponge iron and pig iron production increased by 10% to 29.15 mnt and 4.33 mnt, respectively.

Scrap consumption rises 19% y-o-y

Total scrap consumption increased by 19% to 19.71 mnt in H1FY’26. Consumption of domestic scrap also moved higher, by a more robust 23% y-o-y to 15.5 mnt in H1FY’26. Monthly domestic scrap consumption was lowest at 2.43 mnt in April and highest at 2.82 mnt in August, supported by stable sourcing and strong demand from electric and induction furnaces. Additionally, in the past few months, domestic scrap was available at much cheaper rates compared to imported material, with a price gap of around INR 1,500-2,000/tonne (t).

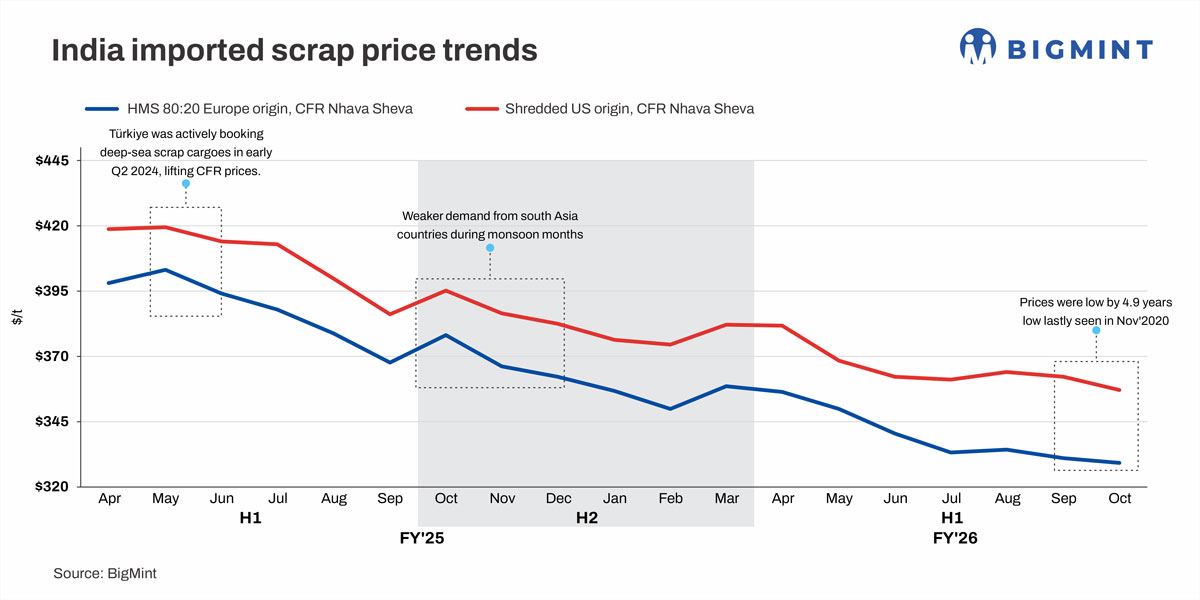

Imported scrap prices trend down y-o-y

Imported scrap prices in South Asia softened y-o-y in H1FY’26 in line with the downtrend in finished steel tags. However, lower prices also led to a favourable buying environment, which supported the increase in imports. Shredded averaged around $367/t in H1FY’26 in India, down from approximately $409/t in H1FY’25, while HMS 80:20 averaged $341/t versus $388/t in H1FY’25.

The decline in prices, alongside strong availability in the market, allowed mills and scrap consumers to secure material at more competitive levels.

Country-wise imports

India’s ferrous scrap import mix in H1FY’26 saw notable shifts. Higher inflows were seen from the US (0.80 mnt, +12%), Brazil (0.29 mnt, +12%), and especially Japan (0.17 mnt, +384%). Conversely, major declines were seen in shipments from traditional sources such as EU-27 (0.39 mnt, -21%), Australia (0.21 mnt, -31%), and Bahrain (0.20 mnt, -32%). The US remained the largest supplier, while Japan emerged as the region with the fastest growth.

The rise in imports from the US was supported by South Asian buyers’ preference for cost-effective, consistent-quality material amid sluggish global demand for low-grade deep-sea scrap. Imports from Japan increased due to operational suitability and timely availability. Mills in south and east India preferred cleaner grades for IF requirements, benefitting from shorter 10-15 day transit times and lower freights, making Japanese scrap more competitive versus longer-haul origins.

Grade-wise imports

HMS imports rose 7% y-o-y to 2.33 mnt, retaining dominance with 55% share of total volumes.

MS shredded declined 3% to 0.65 mnt, being the second-most imported grade.

LMS increased 10% to 0.46 mnt, marking the fastest growth among major grades.

MS turning fell 15% to 0.17 mnt, indicating weaker demand for low-value scrap.

Region-wise imports

- The west (1.78 mnt, +10%) saw strong growth, driven by higher industrial demand and port availability.

- The north (1.28 mnt, -5%) declined slightly due to slow import interest from local mills and more domestic scrap usage.

- The south (0.94 mnt, +11%) also recorded healthy gains amid improved nearshore scrap supply.

- The east (0.20 mnt, -23%) registered the steepest drop with increasing usage of other raw materials such as sponge iron.

Outlook

In Q3, scrap imports are projected to remain stable to slightly higher as secondary producers continue to operate at elevated capacity levels to meet post-festive and construction-related demand. The rationalisation of GST rates, coupled with ongoing manufacturing expansion, is expected to improve liquidity and support domestic scrap circulation. Dependence on imported scrap — particularly from East Asia, the US, and Europe — will also likely persist until domestic collection and recycling capacities expand meaningfully.

Overall, steelmakers — both primary and secondary — are likely to maintain steady production rates through Q3FY’26, supported by festive and infrastructure-driven economic momentum. This is expected to indirectly support ferrous scrap demand in the coming months. However, rising tariff barriers and global trade frictions may limit import flexibility, which may keep mills cautious regarding sourcing.

Leave A Comment