Credits: BIGMINT

- Consumption drops by 5% y-o-y on steel supply glut

- South Asia, US, Vietnam lead growth in scrap imports

- Range-bound trend to continue amid weak steel demand

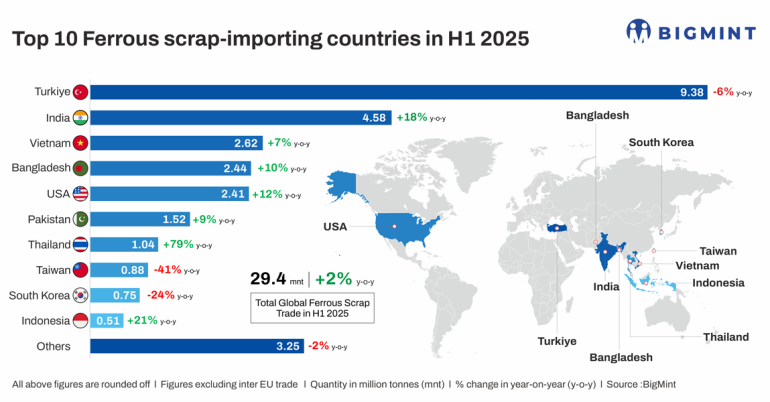

Morning Brief: Global ferrous scrap trade volumes, excluding European intra-trade, increased by around 2% y-o-y to around 29.38 million tonnes (mnt) in January-June 2025, reveals data maintained with BigMint. This marks a slow but steady improvement from almost 28.88 mnt in H1CY’24, despite a global economic slowdown.

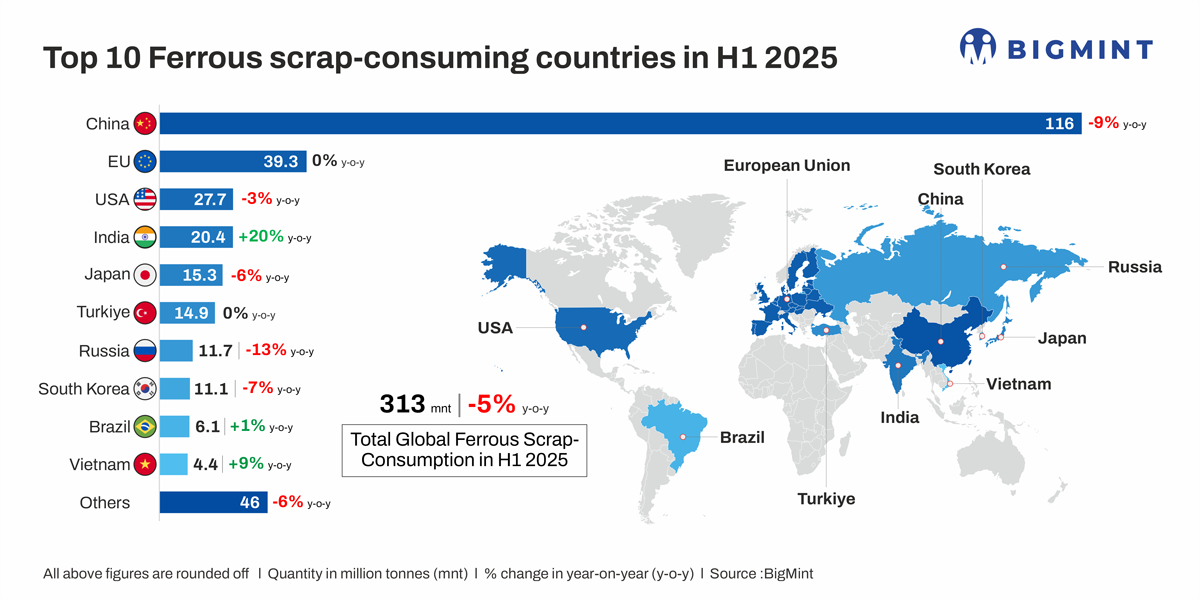

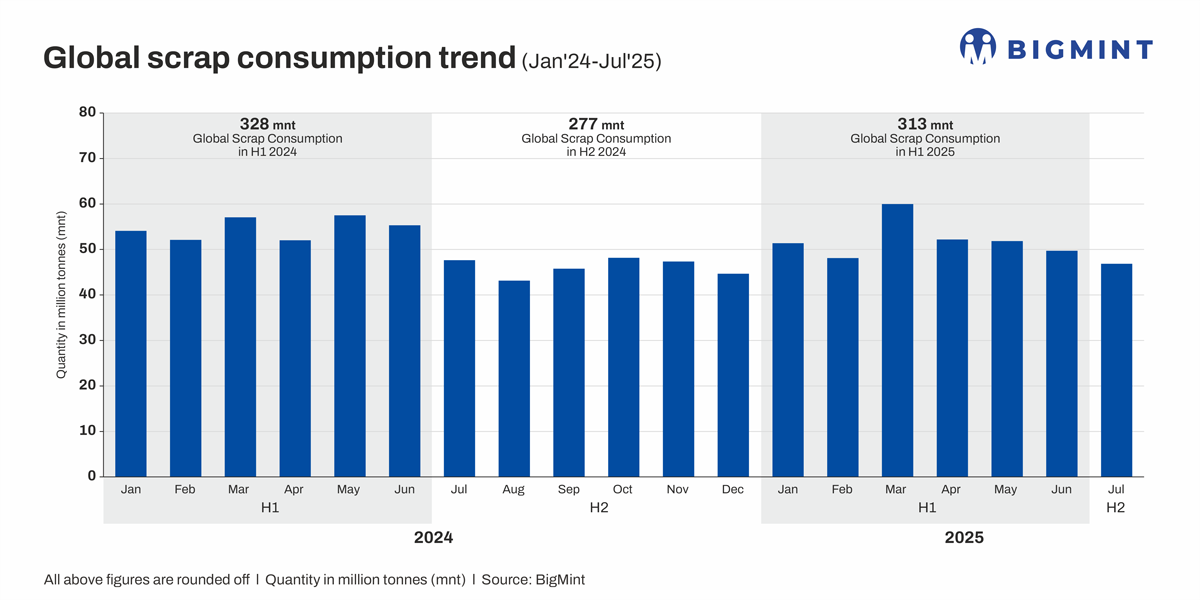

However, the uptrend suggests a contrarian trend, considering that H1CY’25 witnessed a 3% decline in crude steel production to 873 mnt. Ferrous scrap consumption also declined by 5% y-o-y to 313.26 mnt.

Overall, most steel-producing regions witnessed a market slowdown, reeling under a steel supply glut due to soaring exports from China and other macroeconomic weaknesses.

Country-wise breakdown

Turkiye: Turkiye’s total scrap imports fell 6% y-o-y to 9.38 mnt, as mills preferred sourcing billets, amid weak sentiment in the finished steel market. Billet imports rose 27% y-o-y to 4.07 mnt in H1CY’25, as mills lifted their consumption of semi-finished steel to avoid higher conversion costs from scrap to rebar.

India: India’s ferrous scrap imports rose sharply by 18% y-o-y in H1CY’25 to 4.58 mnt, amid an 8% increase in crude steel production to 80.8 mnt, a strong 15% growth in scrap consumption to 19.64 mnt, the arrival of shipments booked earlier, and attractive prices.

Vietnam: A moderate 6.8% uptick was seen in Vietnam’s scrap imports, which totalled 2.62 mnt in H1CY’25. Notably, the country’s crude steel output rose 27% to 11.59 mnt.

Bangladesh: Mills in Bangladesh were able to lift scrap intake due to a sharp decline in scrap prices y-o-y. Bangladesh lifted its imports by 9.6% to 2.44 mnt. Imports from Japan surged amid quick availability at better prices over deep-sea cargoes from the US and other origins.

US: US scrap imports increased by 12% y-o-y in H1CY’25, with scrap usage by domestic mills rising.

Pakistan: Pakistan’s imports were up 9.4% y-o-y at 1.52 mnt, as the country offered better prices over other Asian buyers.

EU, UK raise scrap exports by 5% in Jan-Jun’25

In H1CY’25, the EU and UK raised their ferrous scrap exports to third countries by 5% y-o-y to 11.15 mnt, driven by a 3% drop in crude steel production to 62.8 mnt.

Overall, Europe’s exports climbed up due to better material availability and a decline in scrap consumption. For example, in Germany, crude steel output decreased 11% y-o-y, while scrap prices softened in Q2, weighed down by the appreciation of the euro and tepid domestic demand. The Scandinavian countries also exported lower volumes due to the summer trade lull and geopolitical tensions, while the UK was impacted by subdued Turkish demand, a volatile foreign exchange, and limited container space.

Outlook

Global ferrous scrap imports are expected to remain range-bound in H2CY’25, with some steady growth likely in Q3. Market sentiment is expected to be shaped by continued muted steel demand, cautious buying, and tightening export regulations in key supplying regions.

Region-wise market outlook

EU: Scrap outflows are expected to remain limited under the Waste Shipment Regulation and new surveillance regimes. Rising EAF-based steelmaking capacity will keep more material within the region, curbing availability for overseas buyers.

US/North America: Scrap demand may be stable, limiting exports. Robust EAF adoption and steady steel demand should sustain domestic scrap usage. Export flows are unlikely to expand significantly amid tariff barriers and logistical hurdles.

China: While domestic stimulus may support mild scrap consumption recovery, China’s exporters are expected to keep pushing billet and semis into global markets, adding pressure to regional scrap demand.

Asia excluding China: India and Southeast Asia remain the most promising growth pockets, with urbanisation and infrastructure activity boosting EAF demand. However, rising Chinese billet inflows into Vietnam and Thailand could cap scrap import appetite.

Turkiye: Turkish mills are expected to maintain moderate scrap imports while relying more on billet/semis to manage costs amid firm scrap prices.

Price trends, drivers

With export flows facing growing friction from regulatory barriers, export levies, and higher freight costs, prices are likely to stay stable to mildly upward, with high-quality grades gaining a premium. A major supply disruption remains the only near-term risk for sharp price spikes.

Risks to watch out for include a reduction in steel demand following an economic slowdown in developed markets, new trade restrictions or export bans tightening supply, rising energy/raw material costs inflating collection and processing margins, and currency volatility in Asian markets weighing on import competitiveness.

Global consumption outlook

Scrap consumption is expected to continue its downtrend in Q3CY’25. BigMint data shows consumption stood at 360 mnt in 7MCY’25, a 4% drop from 376 mnt in 7MCY’24.

Specifically, China is likely to see weaker usage similar to H1 if steel output cuts continue in the next quarter. Scrap demand in Japan and South Korea will also remain depressed amid weak steel production. Conversely, the EU and US are expected to ramp up scrap consumption on strong EAF operations. Additionally, solid fundamentals in India point to rising consumption, aided by safeguard duties supporting local producers and stimulating higher scrap usage.

Leave A Comment