Credits: BIGMINT

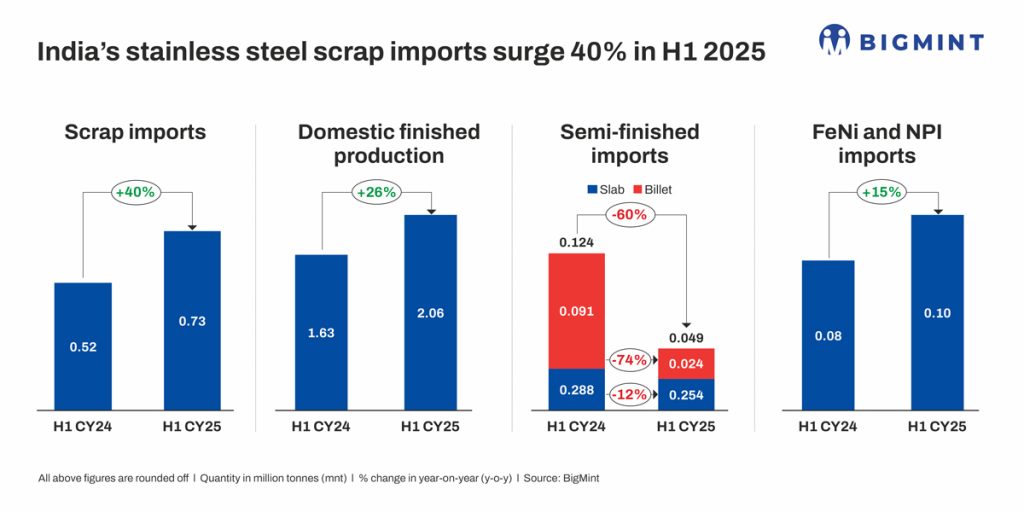

- SS scrap imports reach 0.73 mnt in H1CY’25

- Domestic stainless steel production rises 26% in H1

- Scrap arrivals rose in H1 owing to lower semis inflows

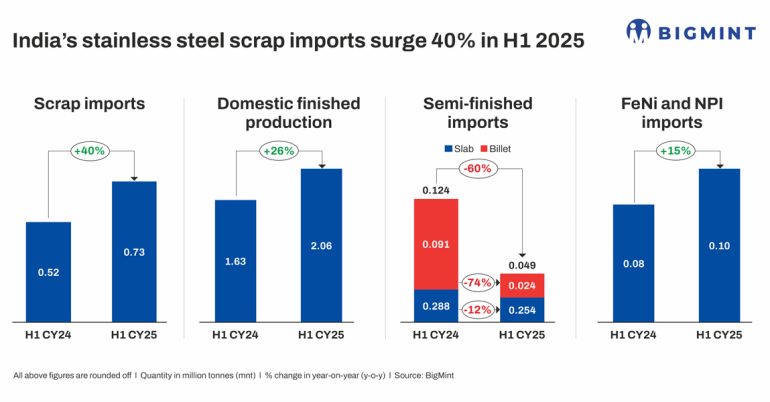

Morning Brief: India’s imports of stainless steel scrap surged by 40% in the first half of calendar year 2025 (H1CY’25), with total shipments recorded at 729,500 tonnes (t) as compared to 519,800 t in H1CY’24, as per BigMint data.

This sharp rise in scrap imports coincided with a decline in arrivals of semi-finished products like slabs and billets, prompting greater use of scrap to support production. Notably, Indonesia, a key supplier, saw its exports of semi-finished products and ferro nickel to India decline during this period.

Series & grade-wise imports

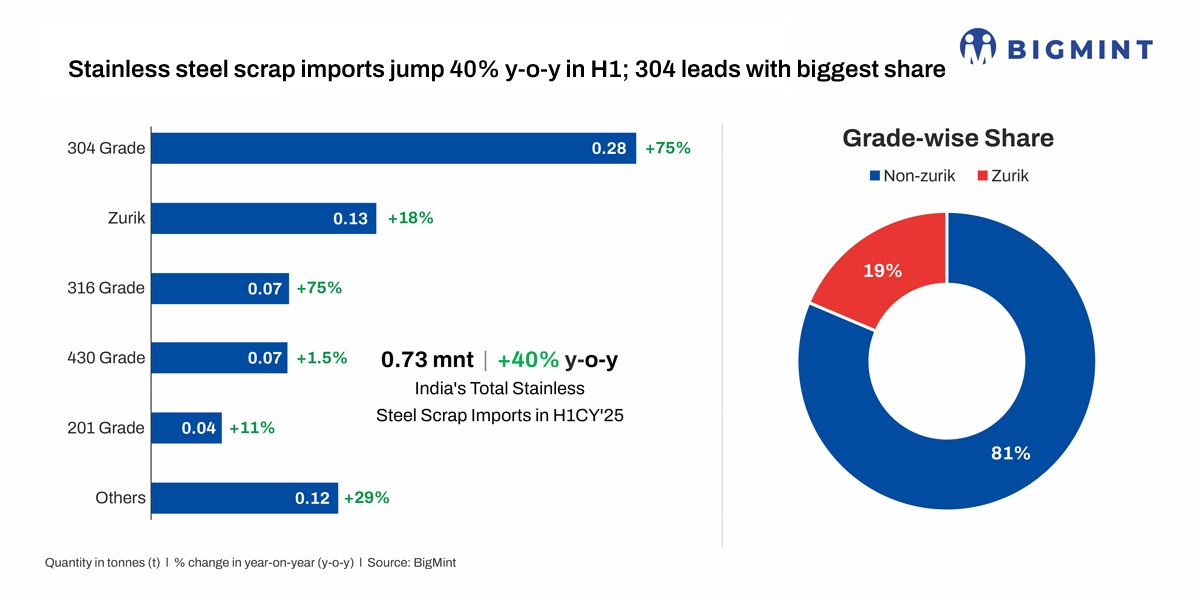

Imports were led by 300-series, with total volumes rising by 53% y-o-y to 520,000 t, while imports of 200-series stainless steel scrap rose by 10% to 56,000 t. Imports of 400-series inched up 5% to 94,800 t.

Among the mainstream grades, 304 scrap imports surged by 70% to 288,200 t, 316 grade increased by 68% to 79,160 t, and Zurik by 24% to 139,500 t. Smaller gains were seen in 430 (+2%), 201 (+11%), and other grades (+30%), reflecting broad-based demand.

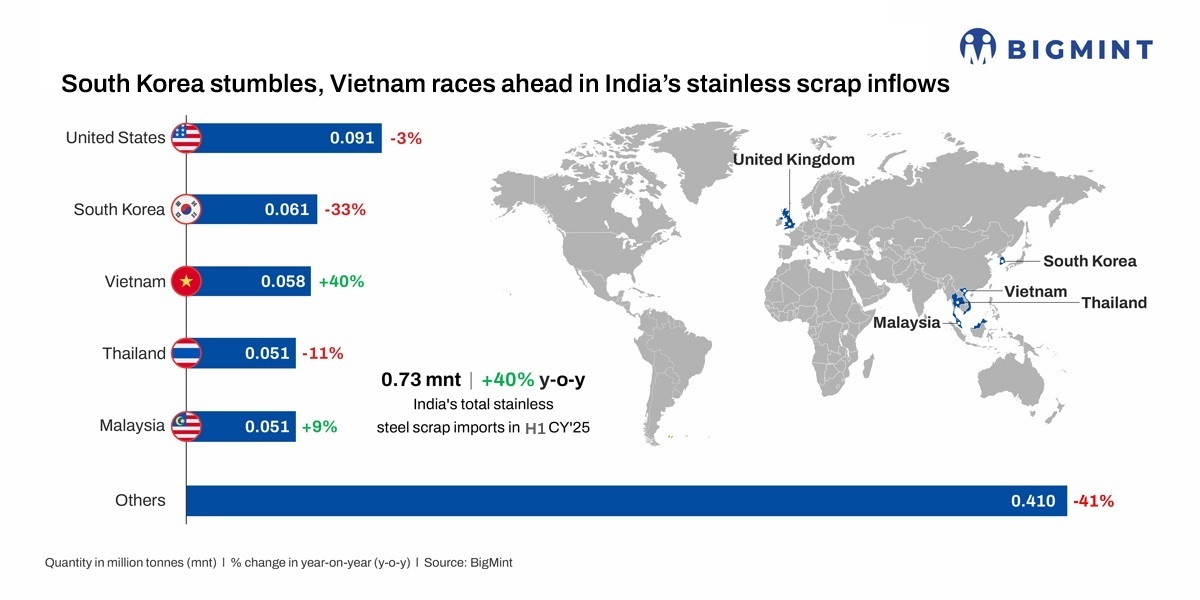

Country-wise imports

The US remained the top supplier with 91,960 t (+4%), while Vietnam (+45%) and South Korea (+32%) saw strong growth. Significant volumes also came from Malaysia, Thailand, and the UK, as buyers diversified sourcing.

Factors driving imports

Growth in domestic production: India’s stainless steel production grew by 26% in H1CY’25 to 2.06 million tonnes (mnt), up from 1.63 mnt in H1CY’24. Notably, the production of finished flats and longs increased by 24% and 28% y-o-y, respectively. This boost in domestic output increased the need for imported scrap.

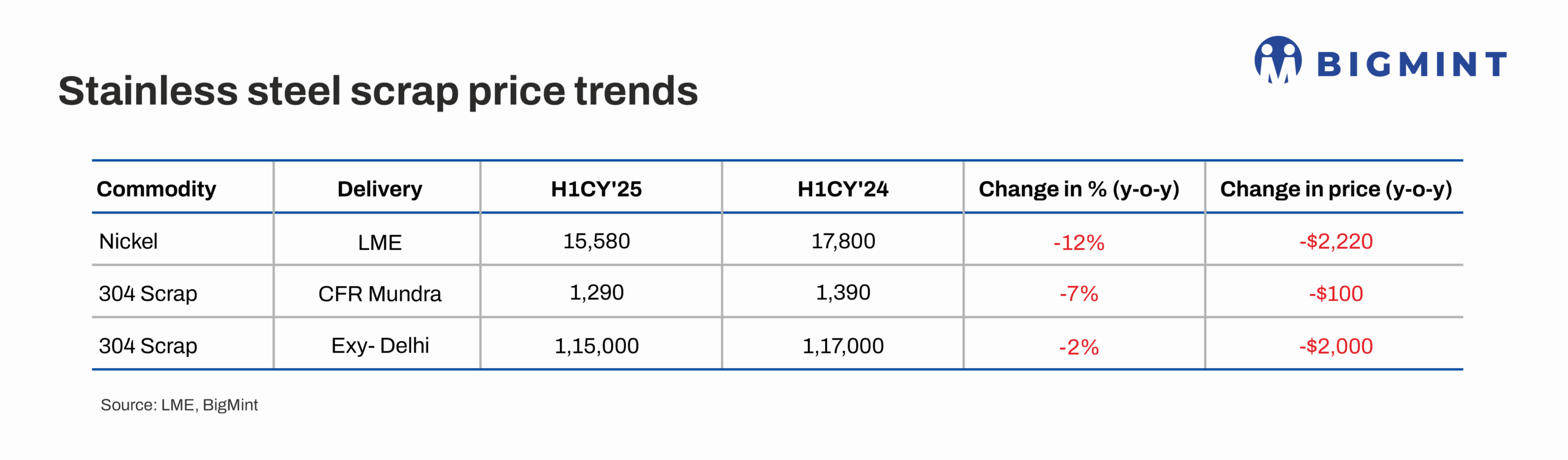

Declining imported scrap prices: Imported scrap prices averaged $1,280-1290/t in H1CY’25, down $90-100/t y-o-y. Domestic scrap prices also fell by 2% y-o-y to INR 114,000-115,000/t. The decline in global prices was largely driven by a 13% drop in LME nickel prices, which averaged $15,300/t during the period, as global nickel inventories continued to rise.

Sharp drop in imports of semis: A significant factor behind the rise in India’s stainless steel scrap imports is the declining preference for semi-finished products such as slabs and billets, which offer cost advantages. Indonesia has emerged as the key supplier of 300-series semi-finished products such as slabs, imports of which declined by 24% to 25,380 t in H1CY’25.

As per provisional data, billet imports dipped from 91,960 t in H1CY’24 to just 24,000 t in H1CY’25, a decrease of 74%. Sweden was India’s largest billet supplier in H1, while Indonesia was the top supplier in 2024, with nearly 67,000 t an impressive jump from the previous year when its share was negligible.

Outlook

India’s stainless steel scrap imports are expected to remain on an upward trajectory in the near term, driven by robust domestic production growth and continued broad-based demand across grades. With Indian mills expanding capacity and seeking cost efficiencies, the momentum in the scrap import market is set to persist in the months ahead.

However, protectionist policies related to scrap exports and the retention of more scrap in the US for domestic consumption are headwinds for Indian importers.

On the domestic front, demand from the construction, consumer appliances and other sectors is expected to see significant growth during the Dussehra-Diwali festive season. Therefore, stainless steel scrap imports are expected to remain supported.

Leave A Comment