Credits: BIGMINT

- Subdued construction activity weighs on scrap demand

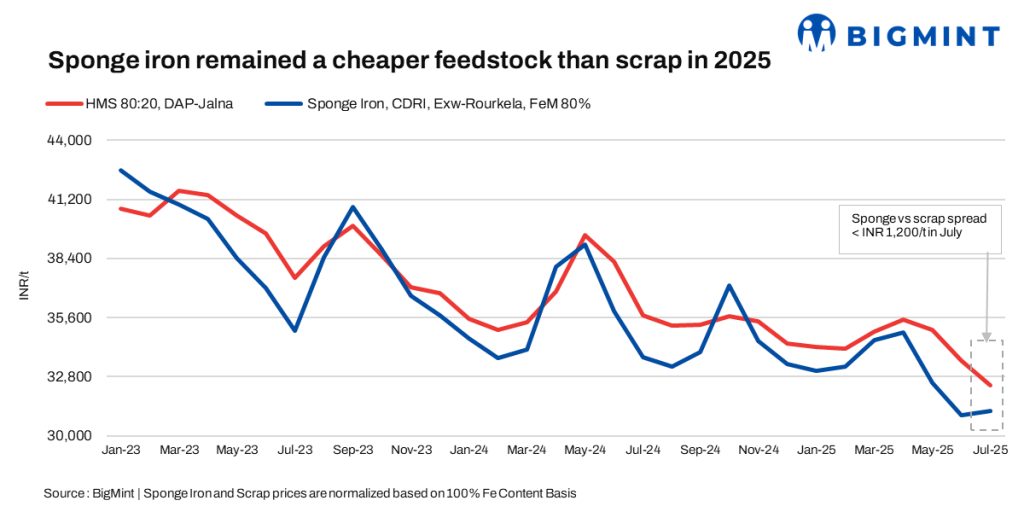

- DRI share rises in charge mix due to cost factor, availability

- Liquidity crunch, rising inventory at yards impact scrap prices

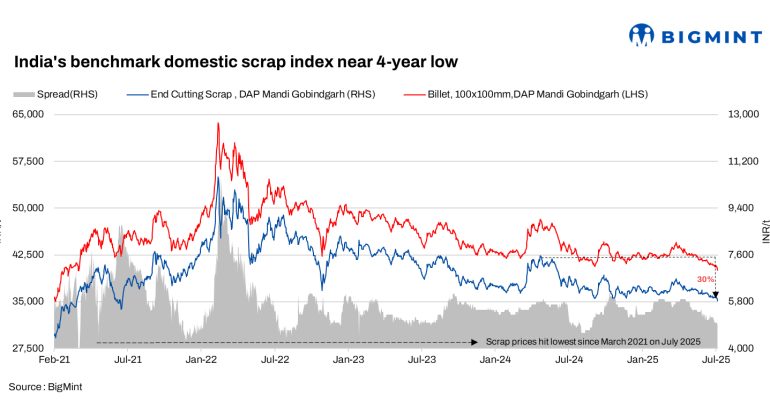

Morning Brief: India’s domestic ferrous scrap market has hit its lowest point in over four years, with prices across key hubs-Mandi Gobindgarh, Chennai and Jalna-declining by INR 2,000-2,500/tonne (t) since May 2025.

Scrap traders and mill sources attribute the decline to sluggish steel market conditions, greater availability of alternative feedstock like sponge iron, deteriorating raw materials-to-finished steel price spreads, and ongoing liquidity constraints affecting the secondary steel sector.

Scrap yards and processors have been compelled to liquidate inventories at reduced prices, with domestic HMS (80:20) now trading between INR 29,000-32,400/t DAP. Mills, particularly in the long products segment, are cutting back on procurement amid compressed margins and weaker construction activity during the monsoon season.

How is tepid steel demand affecting scrap prices?

Steelmakers in the secondary and re-rolling segment are operating at reduced capacity utilisation due to tepid demand for construction-grade products such as rebar and structural steel. Sources informed BigMint that delays in post-election infrastructure spending and the seasonal slowdown in construction activity have curbed offtake of these products.

Rebar prices have softened by INR 200-1,000/t m-o-m across regions, currently ranging between INR 39,000/t and INR 45,000/t in different regions. Billet offers have corrected to INR 36,000-40,500/t. With finished steel and semi-finished product prices under pressure, mills have been forced to lower scrap bid prices to protect margins, further dragging the domestic market downward.

Are mills shifting away from scrap?

An increasing number of mills are showing preference for sponge iron rather than scrap owing to its cost stability and improved availability. Indias sponge iron production is estimated to have reached 55-56 million tonnes (mnt) in FY’25, with installed capacity around 68-70 mnt. Coal-based units which account for over 80% of output have seen strong performance particularly in central and eastern India, facilitating a shift in the charge mix among integrated and induction-route producers.

This transition is most evident in regions where delivered sponge iron remains price-competitive compared to scrap. The consistent supply and predictable yield of sponge iron further incentivise mills to reduce dependence on volatile scrap procurement.

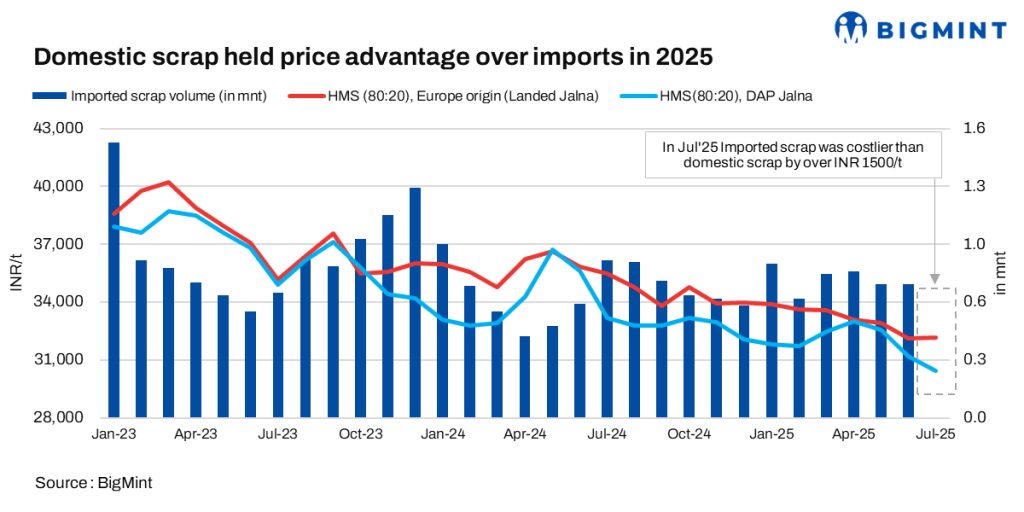

Whats happening in the imported scrap market?

Imported shredded scrap offers remain largely unappealing to Indian buyers amid the domestic downturn. Shredded scrap is currently being quoted at $360-365/t CFR Chennai, equivalent to INR 31,500-32,000/t, placing it at parity or a slight premium to domestic HMS.

Given the elevated ocean freight rates and a sharply depreciated rupee, imported material is being booked only by select mills prioritising specific quality or recovery metrics. In general, the availability of domestic scrap at competitive prices and shorter lead times has reduced reliance on imported material, keeping further upside pressure in check.

How is tight liquidity impacting scrap prices?

Liquidity remains tight across the scrap value chain. Delayed payments, input tax credit (GST) backlogs, and limited working capital availability are pushing traders and scrap processors to liquidate stocks at discounted prices.

Smaller yards and aggregators, in particular, face acute financial strain, forcing them to accept lower bids to generate cash flow. The cash-and-carry nature of the trade, coupled with unpredictable payment cycles from downstream buyers, continues to weigh heavily on procurement dynamics.

How are narrowing spreads influencing buying behaviour?

The spread between raw material input costs-particularly scrap-and finished or semi-finished steel prices has narrowed sharply, eroding profitability for many mills. With operational costs sticky and finished product prices under pressure, producers are scaling back on scrap purchases, instead relying on lower-cost or contract-based inputs.

The price compression has further discouraged bulk restocking of scrap, as mills manage production more conservatively, focusing on near-term demand visibility and margin preservation.

What is the near-term outlook on scrap prices?

In the near term, domestic ferrous scrap prices are expected to remain under pressure and will most likely remain rangebound. Mills are likely to continue managing raw material purchases conservatively amid muted demand, high input costs, and tight liquidity. Any meaningful price recovery would require a rebound in downstream steel consumption, a disruption in sponge iron supply, or a firming up of global scrap benchmarks.

Until then, the Indian scrap market remains weighed down by constrained cash flows and limited restocking interest.

Leave A Comment